Enjoy 0% interest for up to 36 months

What is PayPal Credit?

PayPal Credit is like a credit card, without the plastic. It's a credit limit that's attached to your PayPal account which you can use for your online purchases

What credit offers are available?

If your basket is eligible, a selection of instalment offers will be displayed enabling you to spread the cost of your purchase across a number of monthly payments. Peter Tyson installment purchases qualify for the following options:

It's easy. Just click on the PayPal Credit button at checkout. A selection of instalment offers will be displayed, enabling you to spread the cost of your purchase across a number of payments.

The application form takes minutes to complete. PayPal will then run a credit check and, if approved, you'll have a credit limit linked to your PayPal account as soon as you accept your credit agreement.

You can use the credit limit granted to pay for today's purchase and future purchases at thousands of online stores where PayPal is accepted, up to your credit limit.

About Finance

Please note: All credit applications are subject to status, and terms & conditions apply.

We offer our customers the ability to apply for simple finance facilities to fund a purchase from us via Novuna Capital Finance. If your application is accepted, you will be asked to eSign the credit agreement and once in receipt of your purchase, Novuna Capital will make your agreement live and your monthly repayments will commence for the agreed term. In short, retail finance gives you the flexibility to buy what you really want now, by spreading the cost of your purchase over a repayment period that suits your budget.

A minimum deposit of 10% is required for all finance options, which will be taken by Novuna Capital on behalf of Peter Tyson.

Please note that all options may not be available for all products. Each product will indicate which options are available and are also subject to availability. Products available on an Interest Free option will display an "Interest Free Credt" icon on the product page to indicate this. To see all the finance options available on each product, please expand the finance calculator on the product page or proceed to the checkout where the available options will be displayed when selecting Novuna Captial Finance as the payment option.

Please note: If you are paying by Novuna Capital Finance, goods can only be delivered to the applicant's registered home address.

Buy Now Pay Later - Deferred Payment. Minimum Balance £250.00

Available periods:

● 6 Months Buy Now Pay Later / 48 Months - 16.9% APR representative

● 9 Months Buy Now Pay Later / 48 Months - 16.9% APR representative

● 12 Months Buy Now Pay Later / 48 Months - 16.9% APR representative

Representative example 12 months deferred Buy Now Pay Later:

Purchase price of goods £999.00. Deposit (10%): £99.90. Amount of Loan: £899.10. Duration of agreement 60 months. 48 monthly payments of £29.25. Rate of interest 11.24% p.a fixed 16.9% APR representative. Total amount payable: £1,504.14. Amount of Interest: £505.14. Novuna will tell you the due date of the first repayment. If you repay the agreement in full within the 12 month deferral period then there’s no interest to pay (£29 exit fee applies). If after 12 months, you have not repaid the total amount of credit then you will be charged interest on the outstanding balance from the start of the agreement until the credit is fully repaid.

Monthly payments will commence 12 months from the date your agreement starts and will be payable on the same day in each subsequent month.

Fixed Term Interest Bearing (19.9% APR). Minimum Balance £250.00

Available periods:

● 24 Months Interest Bearing Credit - 19.9% APR representative

● 36 Months Interest Bearing Credit - 19.9% APR representative

● 48 Months Interest Bearing Credit - 19.9% APR representative

Representative example 48 months 19.9% APR:

Purchase price of goods £999.00. Deposit (10%): £99.90. Amount of loan £899.10. 48 monthly payments of £26.54 at an APR of 19.9%. Total Amount Payable: £1374.15 (including deposit). Amount of Interest: £375.15

Interest Free Credit (0% APR). Minimum Balance £500.00

Available periods:

● 6 Months Interest Free Credit - 0% APR representative

● 10 Months Interest Free Credit - 0% APR representative

● 12 Months Interest Free Credit - 0% APR representative

● 18 Months Interest Free Credit - 0% APR representative

● 24 Months Interest Free Credit - 0% APR representative

Representative example 6 months Interest Free Credit:

Purchase price of goods £999.00. Deposit (10%): £99.90. Amount of loan £899.10. 6 monthly payments of £149.85 at an APR of 0%. Total Amount Payable: £999.00 (including deposit). Amount of Interest: £0.00

Who is eligible to apply for online finance?

To apply for finance, you must be over the age of 18, work at least 16 hours a week, or be retired with an income. You must also be a resident of the United Kingdom and have lived in the UK for the last 12 months or more. Unfortunately, we are unable to offer online finance to residents of Eire. Home-makers are not excluded from applying under their own names; however we will require the employment details of your spouse in order to process your application.

Credit is subject to application & status. Terms & conditions apply. Minimum credit purchase £200. Credit is subject to status and affordability. Terms and conditions apply. Peter Tyson, Shaddongate, Carlisle, Cumbria, England, CA2 5TE (Register no. 07404374) trading as Peter Tyson is a credit broker and is authorised and regulated by the Financial Conduct Authority. Credit provided by Novuna Personal Finance, a trading style of Mitsubishi HC Capital UK PLC, authorised and regulated by the Financial Conduct Authority (Register no. 704348).

Buy now and pay later with Pay in 3

PayPal Pay in 3 is PayPal’s buy now, pay later service that lets you split your online shopping basket into three interest-free manageable payments. Make the first payment at the time of purchase and make two more payments on the same date each month. Split your purchases of between £30 and £2,000 into 3 interest-free payments without late fees.

Get to Know Pay in 3

| Purchase Amount | £30-£2000 |

| Number of payments | 3 interest-free payments |

| Time between payments | First payment is made at the point of purchase with the next two payments made automatically on the same date over two months. |

| Repayment method | Repayment method |

| Buyer Protection2 | Included |

| Included | None |

FAQs

Applying for PayPal Credit is easy. Simply complete our short application form here and if approved and once you accept the Credit Agreement, you’ll have a credit limit linked to your PayPal account almost straight away.

The application form takes minutes to complete. We'll then run a credit check and if approved, you’ll have a credit limit linked to your PayPal account as soon as you accept your credit agreement.

To determine the size of your credit line we use the information you provide in the application form along with internal PayPal data and an external credit check.

You can contact PayPal Customer Services to change your business account to a personal account to apply for PayPal Credit. Alternatively, you can create a new personal account to apply.

The first stage of the PayPal Credit application process will ask you to sign into your PayPal account or offer you the opportunity to sign up for one. Once you’ve signed up for a PayPal account, you can begin the application for PayPal Credit. Signing up for a PayPal account is free and easy; all you need to do is provide your email address, create a password and accept our User Agreement.

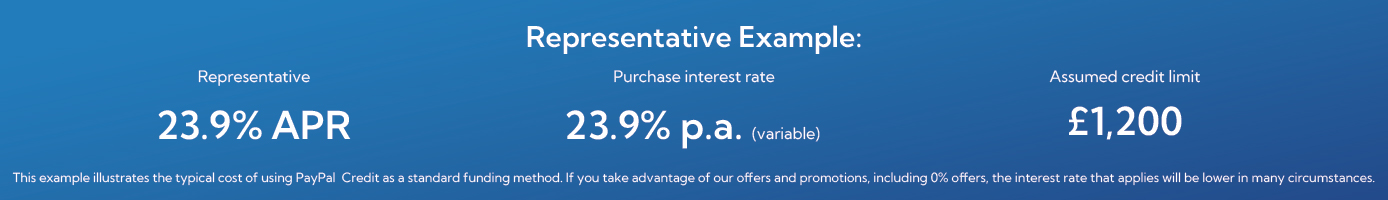

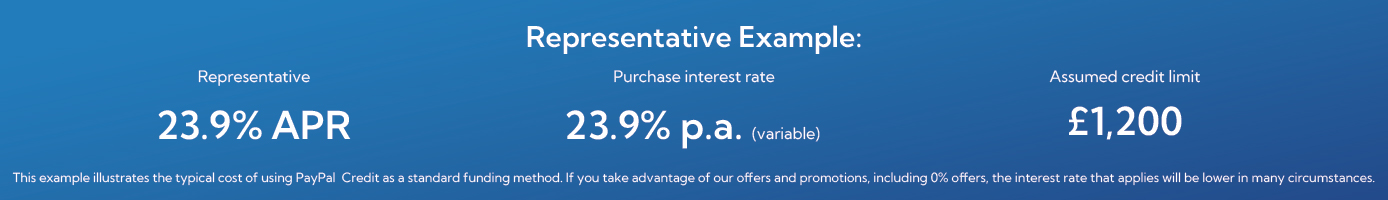

To learn more about PayPal Credit Click Here